2024 Allowable Business Expenses Tax

2024 Allowable Business Expenses Tax – There are many business expenses that you can deduct for tax purposes. You need to keep and there are certain formulas to calculate allowable deductions for other business expenses. . However, significant tax law changes embedded in the thereby increasing the amount of allowable business interest expense. However, starting in the 2022 taxable year, the addback of .

2024 Allowable Business Expenses Tax

Source : www.freshbooks.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comHow to Make Your Travel Tax Deductible in 2024 | Quicken

Source : www.quicken.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.com2024 State Business Tax Climate Index | Tax Foundation

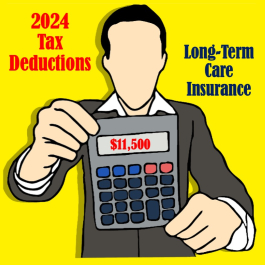

Source : taxfoundation.org2024 Tax Deductible Limits American Association for Long Term Care

Source : www.aaltci.org2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org🚀 Elevate your freelance game Freelancers in Belgium | Facebook

Source : m.facebook.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgMeal and Entertainment Deductions for 2023 2024

Source : ledgergurus.com2024 Allowable Business Expenses Tax 25 Small Business Tax Deductions To Know in 2024: As a baby sitter who provides child-care services in return for compensation, you can deduct certain expenses of your business. You will need to discern the location of your tax home, which . Are business start-up costs tax deductible? If you’re starting a new business, you can deduct $5,000 in start-up costs and $5,000 in organizational costs as allowable business expenses in the first .

]]>